DFW Real Estate Market Update: Mortgage Rates Hit 11-Month Low Post

The Dallas–Fort Worth housing market just got a bit of good news. Mortgage rates dipped to their lowest level in nearly a year, sparking cautious optimism for both buyers and homeowners in North Texas.

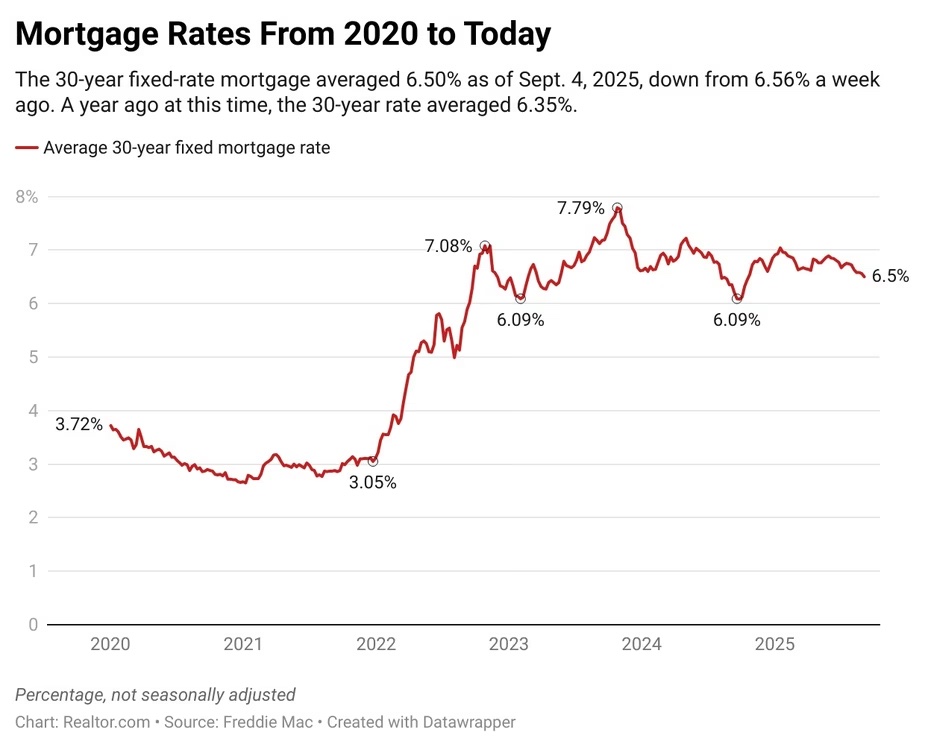

For the week ending September 4, the average 30-year fixed mortgage rate fell to 6.5%, down from 6.56% the previous week, according to Freddie Mac. One year ago, during the same period, rates averaged 6.35%. While not a massive drop, this trend has kept market watchers encouraged.

Sam Khater, chief economist at Freddie Mac, noted: “Mortgage rates continue to trend down, increasing optimism for new buyers and current owners alike. As rates continue to drop, the number of homeowners with an opportunity to refinance is expanding.” Refinancing applications now account for nearly half of all new mortgage activity, the highest share since October.

🔎 What’s Driving Mortgage Rates Right Now?

The latest dip reflects a “wait-and-see” mood in financial markets as investors anticipate the Department of Labor’s August jobs report.

If job growth comes in weak, markets may bet on Federal Reserve rate cuts, lowering bond yields and putting more downward pressure on mortgage rates.

If job growth is strong, inflation fears may push Treasury yields up, nudging mortgage rates higher.

As Hannah Jones, senior economic research analyst at Realtor.com, explains: “This setup underscores the potential for increased mortgage rate volatility ahead.”

🏠 Impact on the DFW Housing Market

The DFW housing market has been in a delicate balance this summer. Affordability challenges remain, with buyers stretched by higher borrowing costs and sellers reluctant to slash asking prices.

Buyers: Many have been sidelined, waiting for better affordability before making a move.

Sellers: Some have even delisted their homes, holding out for stronger conditions instead of cutting into profit margins.

Inventory: While listings have improved, high costs and economic uncertainty continue to weigh on demand across Dallas–Fort Worth.

Adding to the pressure, insurance premiums are rising in many high-risk areas across Texas. Climate-related exposures — from flooding to wind and wildfire — have become a growing financial burden, reshaping buyer behavior and long-term affordability in some neighborhoods.

📈 How Mortgage Rates Are Calculated

Mortgage rates are closely tied to the 10-year Treasury bond yield, which reflects broader expectations around inflation and economic growth.

When inflation rises → Treasury yields go up → mortgage rates climb.

When inflation eases or jobs data weaken → Treasury yields fall → mortgage rates decline.

But the rate you personally qualify for goes beyond the benchmark. Lenders weigh your:

Credit score

Loan amount and term

Property type

Down payment size

Strong financial profiles mean lower risk to lenders, often resulting in lower interest rates.

💡 What This Means for DFW Buyers and Sellers

For buyers in Dallas–Fort Worth, every fraction of a percent matters. A lower rate can translate into hundreds of dollars in monthly savings or allow you to afford more home in competitive areas like Frisco, Plano, or Southlake.

For sellers, slightly lower rates may help unlock pent-up demand as affordability improves. This could mean more showings, faster offers, and fewer buyers sitting on the sidelines.

✅ Bottom Line: Mortgage rates in DFW have hit an 11-month low, bringing hope to both buyers and sellers. But with employment data and Federal Reserve decisions on the horizon, expect some volatility. If you’re considering a move in North Texas, now is the time to stay closely tuned to market conditions.